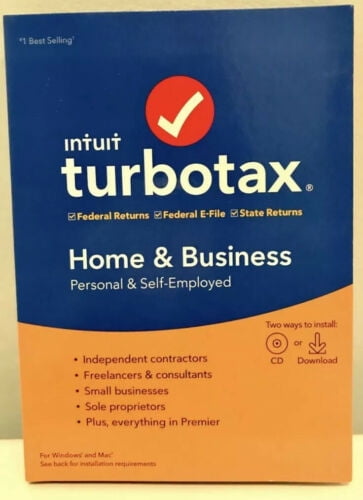

This is the best and easiest to use tax software available for Windows XP/Vista/7/8 or higher and Mac OS X (10.6.8 or higher).Ĭompletely updated with the latest tax law changes, tax-saving advice, and a streamlined interface for easy, confident filing, TurboTax Home & Business has many powerful features.

TURBOTAX HOME AND BUSINESS CODE

Manufacturer part 5100250 Dell part AB807916 Order Code ab807916 Intuit. I downloaded TT and was able to do a simple return with one.2 answers I have the same issue. It combines the power of TurboTax Premier America's #1 tax preparation software with special features and advice for sole proprietors.Īnd Powerful Enough for your Schedule C Business Taxes, including TurboTax Home & BusinessPersonal & Self-Employed. I have spent 8 hours in two days on TT support and an hour with Apple support. TurboTax Home & Business is the complete program for filing both your personal and small business taxes. TurboTax Premier does have Schedule E Supplemental Income and Loss, including rental property.

Recommended if you are self-employed, an independent contractor. Otherwise, the 2 desktop programs have the same capabilities. /rebates/2fturbotax-home-business-2021-for-1-user-windows-download-51002502fproduct24509985&. TurboTax Home & Business is recommended if you received income from a side job or are self-employed, an independent contractor, freelancer, consultant or sole proprietor, you prepare W- MISC forms for employees or contractors, you file your personal and self-employed tax together (if you own an S Corp, C Corp, Partnership or multiple. TurboTax Home and Business 2021 Federal + State is tailored to your unique situation. To deduct these expenses, you must use TurboTax Self-Employed or TurboTax Home. Business expenses are deducted on Schedule C.

These expenses must be common for your type of business and also necessary for your operations. TurboTax Home and Business Federal & State Returns + E-File 2012 Win/Mac. If you’re self-employed or own a small business, you can deduct eligible business expenses in order to pay fewer taxes.

TURBOTAX HOME AND BUSINESS PC

TurboTax 2019 Home & Business Software CD PC and Mac Old Version by TurboTax. This is a new, never used, fully registrable 2013 TurboTax Home & Business Federal + State + 5 Federal Personal Efiles and ItsDeductible software package. The biggest difference between the 2 programs is the ease of use for self-employed personal & business income and expenses. Turbo Tax Home and Business - Tax Year 2015 PC/MAC Disk OLD VERSION by Turotax.

0 kommentar(er)

0 kommentar(er)